Oil production in Nigeria slumped by 15.5% in July from June, marking the third month-on-month decline since April, according to data from the local upstream regulator.

Last month’s oil production in the African OPEC member fell to 1,081,396 barrels per day (bpd) from 1,248,960 bpd produced in June, per the crude oil and condensate production data of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) reported by local media.

‘;document.write(write_html);}

Nigeria has consistently failed to produce to its quota in the OPEC+ agreement. The combination of pipeline vandalism and oil theft with a lack of investment in capacity has made Nigeria the biggest laggard in crude oil production in the OPEC+ alliance. Oil theft and pipeline vandalism have long plagued Nigeria’s upstream oil and gas industry, driving majors out of the country and often resulting in force majeure at the key crude oil export terminals.

‘;document.write(write_html);}else{var write_html=”;document.write(write_html);}

Nigeria’s oil production is around 1 million bpd below its capacity. The government has cited a lack of investments, a shortage of funding sources because of the energy transition, and insecurity among the factors driving the situation.

“Currently, Nigeria has the technical allowable capacity to produce about 2.5 million barrels of oil per day. However, arising from the highlighted challenges, our current production hovers around 1.5 million barrels of oil and condensate per day,” Gbenga Komolafe, chief executive at the NUPRC, said in May.

Oil Prices Remain Flat As Supply Shocks Counter Macroeconomic Concerns

![]()

More Info

By Michael Kern – Aug 29, 2023, 8:45 AM CDT

Oil prices continue to trade sideways this week, with supply shocks being counteracted by continued macroeconomic pessimism.

‘;document.write(write_html);}

‘;document.write(write_html);}else{var write_html=”;document.write(write_html);}

Chart of the Week

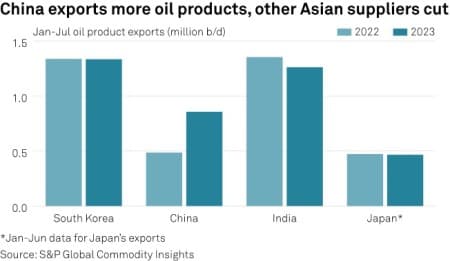

– China has at last issued product export quotas that would enable Chinese refiners to ship their surplus barrels overseas, with state-owned Sinopec getting the highest quota share of all.

– According to market sources, China will export around 3.5 million tonnes of oil products in September, with almost half of it coming from jet fuel, a 10% month-on-month increase compared to August allocations.

– Just as Asian refining margins soared to $15 per barrel, the highest in 2023 to date, China’s total annual export quota is set to rise to 41 million tonnes, almost 4 million tonnes higher than in 2022.

– China’s monthly product exports are still yet to surpass their annual peak in February when 1 million b/d was exported, with exporters struggling to regain market share in Singapore and forced to rely more on demand from Malaysia and Hong Kong.

Market Movers

– Brazil’s national oil firm Petrobras (NYSE:PBR) signed a strategic cooperation agreement with China’s CNOOC (HKG:0883) on refining, oilfield services, green energy, and oil trading, paving the way for more Chinese investment into the Latin American country.

– Norway’s oil major Equinor (NYSE:EQNR) has acquired a 25% stake in the Bayou bend carbon capture storage project in southeast Texas, joining Talos Energy and Chevron in the project.

DETAIL: Nigeria’s oil and gas sector attracts FDI

A worker inspecting facilities on an oil drilling platform in Nigeria. The oil and gas sector there has been the largest beneficiary of FDI

Author: Dolapo Kukoyi, Partner, DETAIL Commercial Solicitors

Nigeria received the largest amount of Foreign Direct Investment (FDI) of any African country over the period 2010-13. These inflows have grown in the last few years (see Fig. 1) – Nigeria’s National Bureau of Statistics recorded a total of $21.3bn of FDI in 2013, a 28.3 percent growth from the total FDI of 2012, which was calculated at $16.6bn.

On the equity side, FDI from January to May 2012 was at $648m, while in the same time frame for 2013 it was calculated at $811m. A major statistical difference however, can be seen in the Portfolio Investment (PI) for Nigeria, which indicates that investors have a preference for PI due to predictability in returns. From January to May 2012, PI in the form of equity, bonds and money market instruments was $4.42bn, $206m and $423m respectively. Similarly, in the same time frame for 2013, PI in the form of equity, bonds and money market instruments were calculated at $7.09bn, $749m and $565m respectively.

The power sector has been identified as a major growth area of the Nigerian economy

Distributing investmentThe principal legislations regulating FDI in Nigeria are the Nigerian Investment Promotion Commission Act and the Foreign Exchange Monitoring & Miscellaneous Provisions Act. These laws guarantee the unrestricted transfer of dividends or profits derived from FDI and unhindered remittance of proceeds (net of taxes) in the event of sale or liquidation.

Historically, the largest beneficiary of FDI has been the oil and gas sector. Over the past year, this industry in Nigeria has witnessed divestments by International Oil Companies (IOCs). This has created opportunities for indigenous oil companies to participate in the upstream sector of the industry. However, due to the high costs involved, a number of indigenous companies have relied on FDI to fund their acquisitions of these upstream assets, mostly through international equity inflows.